Online shopping has transformed how we buy everything, from groceries to gadgets. In 2023, global e-commerce sales hit a staggering $5.8 trillion, showing just how much we’ve embraced digital shopping. But here’s the thing – while we love the convenience of shopping online, paying for everything at once isn’t always ideal.

PayPal noticed this challenge and created the PayPal Buy Now Pay Later service. It’s a simple solution that lets you get what you need now and pay over time in a way that fits your budget. Let’s figure out what it is together!

What Is PayPal Buy Now Pay Later?

Online shopping just got easier with PayPal Buy Now Pay Later. This handy service lets you buy what you need today and split the payments over time. It’s like having a flexible payment plan right at your fingertips when you shop online.

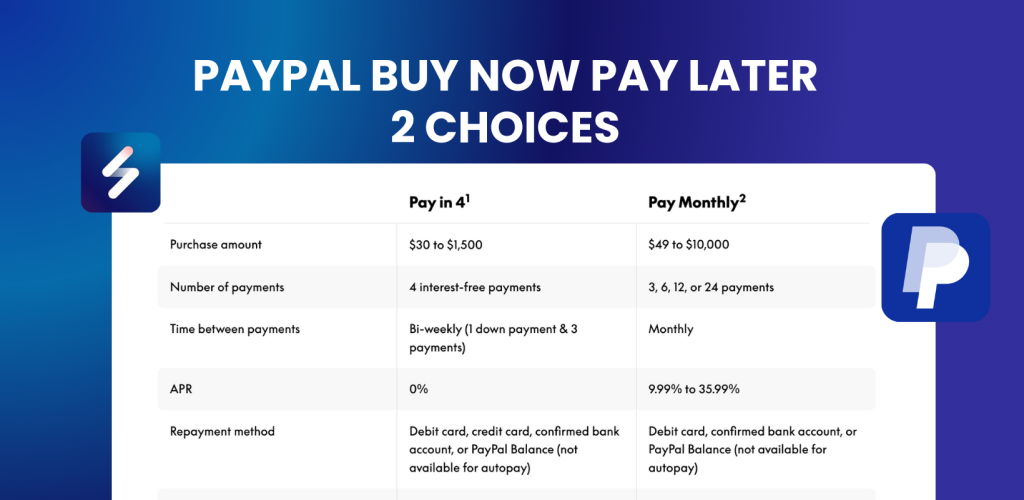

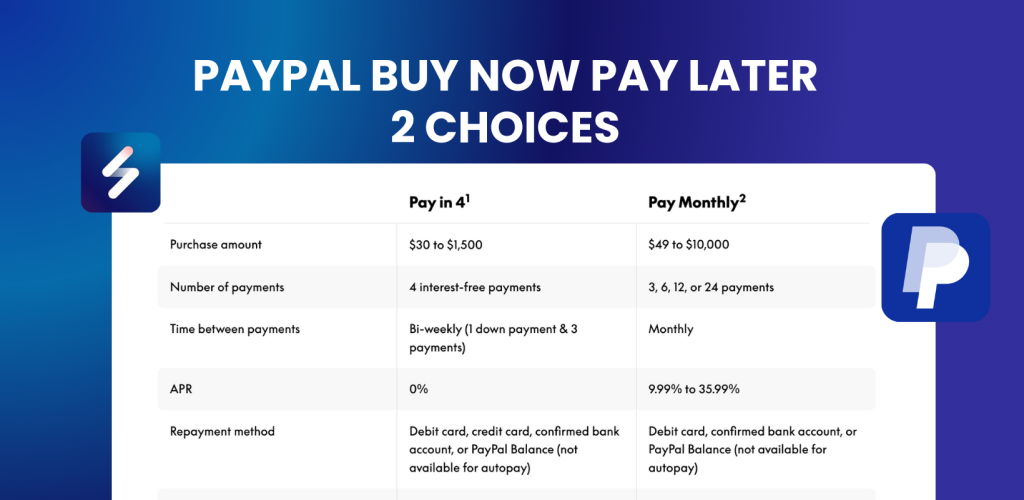

Think of PayPal Buy Now Pay Later as a friendly payment helper that gives you 2 main choices for paying over time:

- Pay in 4 – Split your purchase into four equal payments. Here’s how it works:

-

-

- Your first payment happens when you buy

- You pay the rest every two weeks

- No interest charges – you only pay what the item costs

- Works for purchases between $30 and $1,500

- Pay monthly – For bigger purchases, pay monthly might be your answer:

-

- Split payments over 6, 12, or 24 months

- Buy items between $199 and $10,000

- Interest rates depend on your credit history

- Fixed monthly payments make budgeting easier

How Does PayPal Buy Now Pay Later Work?

Getting started with PayPal Buy Now Pay Later is straightforward. When you’re shopping online and ready to check out, here’s what happens:

Quick Eligibility Check

First, PayPal needs to make sure you qualify. Don’t worry – it’s fast and won’t hurt your credit score. When you’re checking out:

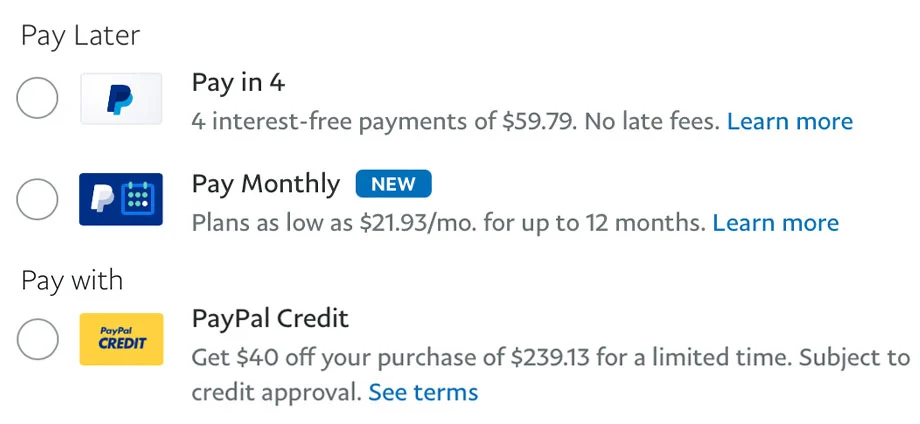

- Choose PayPal as your payment method

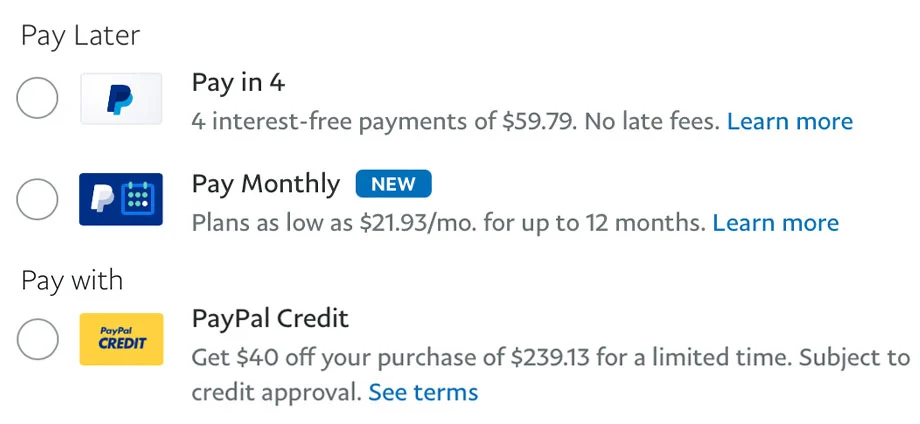

- Select either “Pay in 4” or “Pay Monthly”

- PayPal does a quick soft credit check (this won’t affect your credit score)

- Get an instant decision

Simple Application Process

If you’re approved, setting up your payment plan is easy:

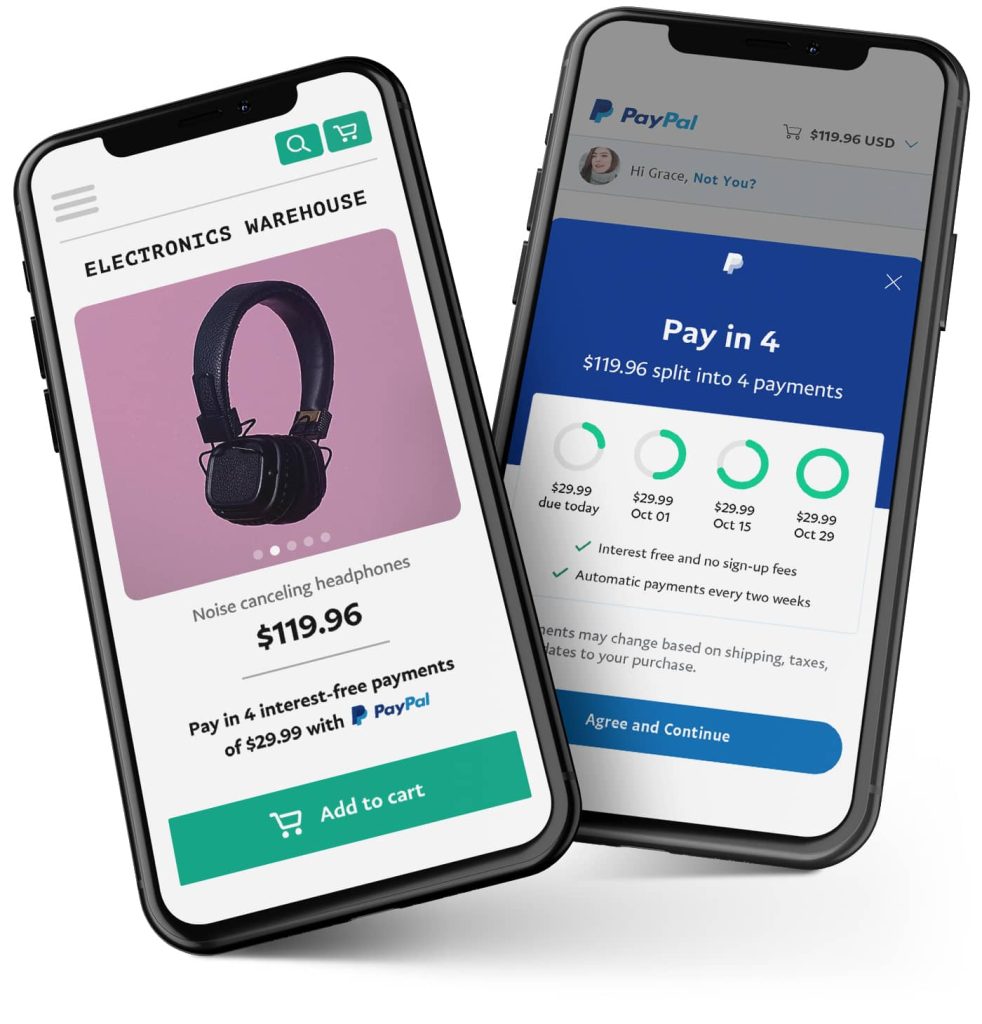

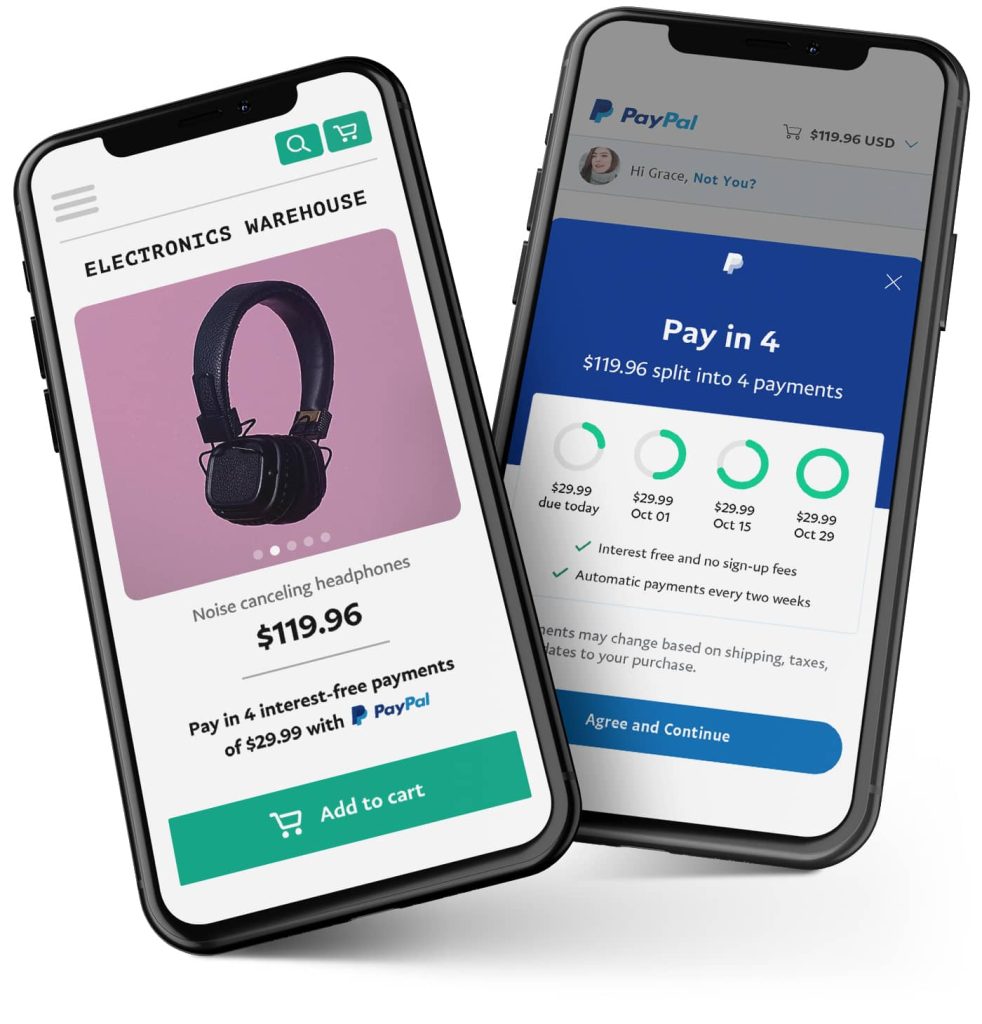

- For Pay in 4: Make your first payment at checkout, then PayPal schedules three more payments every two weeks

- For Pay Monthly: Choose your payment term (6, 12, or 24 months), review your interest rate, and set up your monthly payments

Automatic Payments Make Life Easier

Once you’re set up, PayPal handles the rest:

- Links to your preferred payment method (bank account, debit card, or credit card)

- Automatically takes payments on schedule

- Sends reminders before each payment

- Shows your payment schedule in your PayPal account

Think of it like setting up auto-pay for your bills – once it’s set up, you don’t have to worry about remembering to make payments. PayPal takes care of that for you.

Why Use PayPal Buy Now Pay Later?

For Shoppers

Want to make online shopping easier on your wallet? Here’s why more and more people are loving PayPal Buy Now Pay Later:

- No interest on Pay in 4: The biggest draw is the cost savings:

- Cut your payment into four smaller, bite-sized pieces

- No sneaky fees hiding in the fine print

- Pay just the price tag, nothing more

- Works great for purchases from $30 to $1,500

- Flexible options for big purchases: When you need to buy something more expensive, Pay Monthly helps:

- Take 6, 12, or even 24 months to pay

- Shop for items up to $10,000

- See exactly how much you’ll pay each month

- Pick a payment schedule that works for you

- Quick and easy approval: No long wait times here!

- Know right away if you’re approved

- Skip the hassle of paperwork

- Just a few clicks at checkout

- Don’t worry – checking if you qualify won’t hurt your credit score

- More buying power: This service helps you manage your money better:

- Buy necessary items now and pay over time

- Plan bigger purchases more easily

- Better alternative to credit cards for some purchases

- Keep track of all payments in your PayPal account

For Merchants

For businesses, PayPal Buy Now Pay Later isn’t just another payment option – it’s a powerful tool for growth.

- Boost your sales performance:

-

-

- Drive higher conversion rates as customers are more likely to complete purchases

- Increase average order values – shoppers tend to spend more when they can split payments

- Keep customers coming back with flexible payment options

- Attract shoppers who love buy now, pay later options

- Zero risk, full payment upfront. Unlike traditional financing options, PayPal buy now pay later offers more:

- Money in your account as soon as the sale happens

- Let PayPal handle the payment collection

- No stress about unpaid bills

- Keep your cash flow healthy

- Save time and resources with easy setup:

-

- Works automatically if you already use PayPal Checkout

- No extra services to buy

- Quick setup without tech headaches

- Works with most online store platforms

- Reduce cart abandonment, helps convert hesitant shoppers:

-

- Make prices less scary for customers

- Help customers afford bigger purchases, increase sales

- Provide payment flexibility without credit cards

- Enable immediate purchases for budget-conscious shoppers

Our Key Takeaways

| For Shoppers |

For Merchants |

| Split payments with no extra cost |

Drive higher conversion rates |

| No hidden fees or surprises |

Increase average order values |

| Manage purchases between $30 and $10,000 |

Get paid upfront, PayPal handles collections |

| Flexible terms: Pay in 4 or Pay Monthly |

No risk of customer defaults |

| Instant, simple approval process |

Easy integration with PayPal Checkout |

| Helps budget for larger purchases |

Attract new customers with BNPL options |

| A soft credit check won’t hurt your credit score |

Reduce cart abandonment for large purchases |

Think of PayPal Buy Now Pay Later as a win-win deal: shoppers get breathing room with their budget, and businesses watch their sales grow. Pretty neat, right?

What Is the PayPal Pay Later Limit?

With so many benefits and potential, what are the downsides of PayPal’s Buy Now, Pay Later option? Nothing is perfect, including PayPal’s Buy Now, Pay Later. Let’s explore its drawbacks and help you make an informed decision about using this payment method.

Limit in Options

The first limit is that PayPal Buy Now Pay Later only offers 2 distinct payment options, each with specific spending thresholds:

| Payment Option |

Purchase Range |

Payment Structure |

| Pay in 4 |

$30 – $1,500 |

4 interest-free installments |

| Pay Monthly |

$199 – $10,000 |

6-24 month terms with interest |

Online-Only Restriction

Next, unlike competitors such as Klarna and Afterpay which offer both online and in-store payment options, PayPal Buy Now Pay Later currently supports online purchases exclusively. This limitation means:

- No in-store payment options available

- Restricted to merchants accepting PayPal

- Online-only transaction processing

Financial Risk Factors

Finally, the convenience of Buy Now, Pay Later services can lead to potential financial challenges:

-

-

- An easy approval process may encourage impulsive purchases

- Multiple payment plans can accumulate quickly

- Risk of overextending your budget

- Potential debt accumulation if not managed properly

- Credit impact considerations

-

- Payment history may affect credit scores

- Collection activities appear on credit reports

- Multiple applications could impact creditworthiness

- Late payments remain on financial records

- Payment-related fees: While PayPal doesn’t charge direct late fees, users may encounter:

- Bank overdraft charges for failed payments

- Interest charges when using credit cards

- Insufficient funds penalties from banking institutions

- Account restrictions following multiple declined payments

FAQs

Can I Buy Now and Pay Later on PayPal?

Yes, PayPal offers “Buy Now, Pay Later” options, including:

- Pay in 4: Split purchases into four interest-free payments, with the first due at checkout and the remaining three every two weeks.

- Pay Monthly: For larger purchases, this option allows fixed monthly payments over 6, 12, or 24 months, with interest rates based on creditworthiness.

What Countries Is PayPal Pay Later Available In?

PayPal’s Pay Later services are available in several countries, including:

- United States: “Pay in 4” and “Pay Monthly” are available.

- United Kingdom: “Pay in 3” allows splitting purchases into three payments.

- Australia: “Pay in 4” is available for eligible purchases.

- France: PayPal has extended BNPL options to this region.

Availability varies by country, and not all services are offered everywhere.

How Do I Activate Pay Later on PayPal?

To use PayPal’s Pay Later options:

- Select PayPal at Checkout: Choose PayPal as your payment method on the merchant’s website.

- Choose a Pay Later Option: If eligible, you’ll see options like “Pay in 4” or “Pay Monthly.” Select your preferred plan.

- Apply and Agree to Terms: Complete the application process, which may include a soft credit check, and agree to the terms.

- Complete Purchase: Once approved, finalize your purchase. Payments will be automatically deducted per the agreed schedule.

Why Won’t PayPal Let Me Buy Now Pay Later?

Several factors may prevent access to PayPal’s Pay Later services:

- Eligibility Criteria: You must be at least 18 years old and meet credit requirements.

- Purchase Amount: Transactions must fall within specified limits (e.g., $30 to $1,500 for “Pay in 4” in the U.S.).

- Location Restrictions: Some services aren’t available in certain regions or states.

- Merchant Participation: Not all merchants offer Pay Later options.

- Account Standing: Your PayPal account must be in good standing, with no unresolved issues.

If you’re unable to use Pay Later, consider contacting PayPal customer support for assistance.

Final Words

Whether you’re shopping or selling, PayPal Buy Now Pay Later could be a game-changer for your online transactions. But just remember, like any financial tool, it works best when you use it thoughtfully. For merchants, check out Synctrack PayPal Tracking Sync to make things easier by automatically sending tracking details to PayPal quickly and accurately. Hope this helps!